Business Plan with a strong focus on capturing growth of power demand

We are entering an era of sustained growth of power demand, namely supported by strong data centers deployment in the US, and renewables are the cheapest, fastest and most scalable technology.

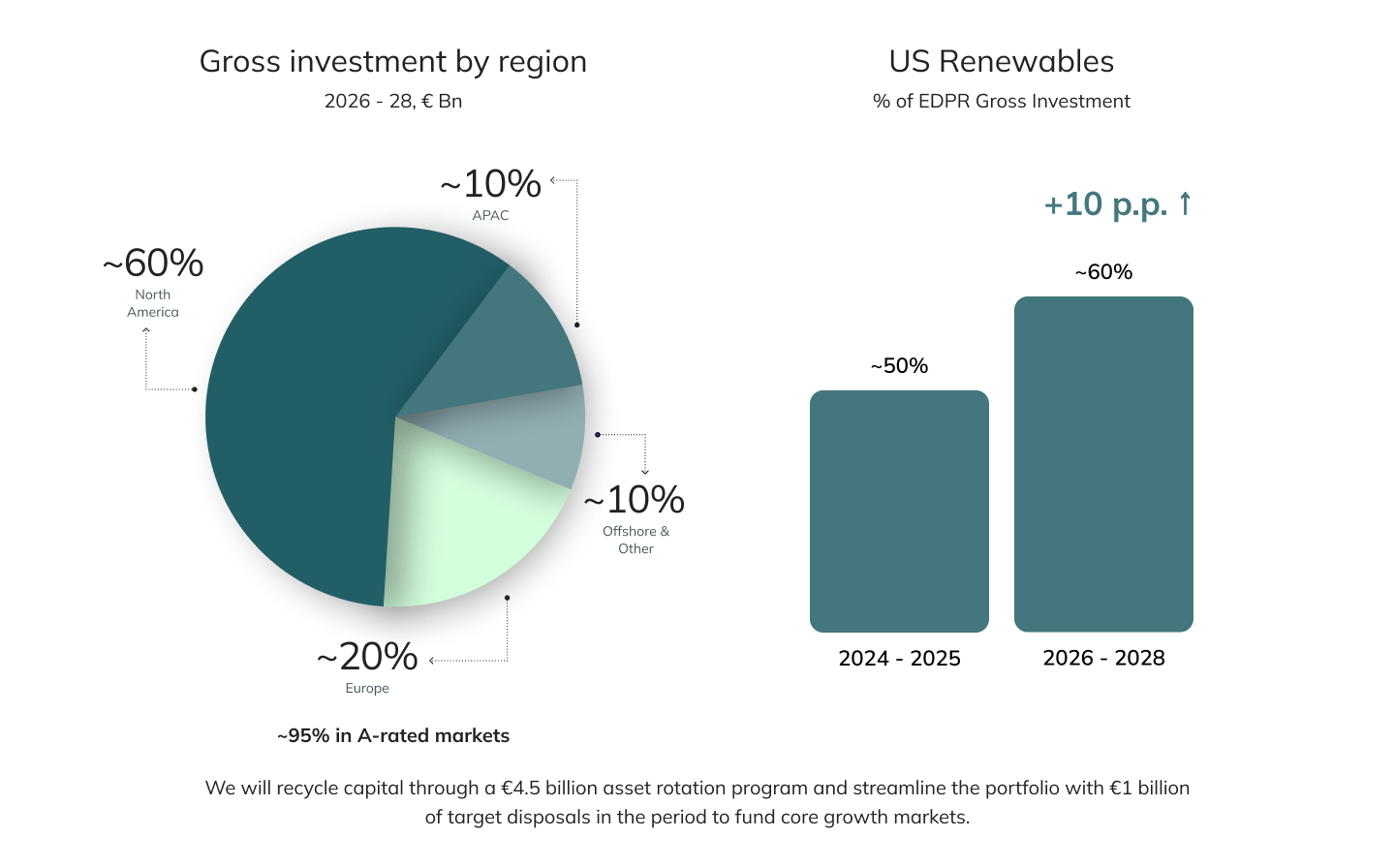

In this context, EDPR's 2026-28 Business Plan was designed to capture electricity demand growth driven by electrification and data centers deployment, with renewables in the US at its core.

Macro context

-

Entering an era of sustained growth of power demand

-

Renewables are the cheapest, fastest and most scalable technology

-

More flexibility needs with increasing value pools

-

Market and regulatory tailwinds

-

EDPR leader in Renewables with strong track record and pipeline, namely in US

-

Strong relationship and origination track record with Big Tech and US utilities

-

Strong hedging and risk management, leveraging EDP’s Energy Management capabilities

Our 2026-2028 commitments

Our strategy is designed to create value that endures for shareholders, customers and communities alike - by expanding renewable energy that powers homes, cities and industries, and driving continuous efficiency through responsible action and innovation.

Focused growth

- ~€7.5 Bn investment plan with enhanced returns – focus on US renewables

- ~€4.5 Bn Asset Rotation delivering value crystallization and recycling capital to fund growth

Business optimization

- ~€1 Bn Disposals to refocus in attractive core markets and businesses

- Improving efficiency metrics through operational excellence (~26% OPEX/Gross Profit)

Distinctive and resilient portfolio

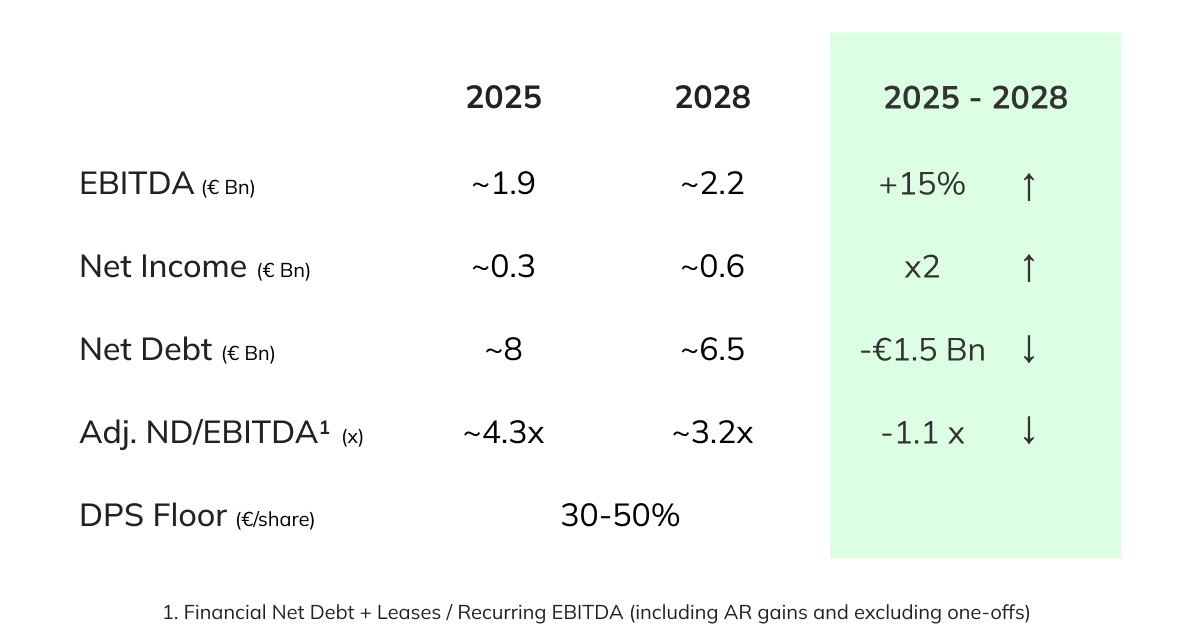

- ~90% EBITDA in A-rated markets and highly contracted profile (~90% regulated + LT contracted/hedged)

- Improving credit ratios (-1.1x Adj. ND/EBITDA), providing increased optionality

Value creation

- Increasing EBITDA to ~€2.2 Bn by 2028 (+15% vs 2025) while decreasing Net Debt by €1.5 Bn

- Increasing Net Income to ~€0.6 Bn by 2028 (x2 vs. 2025)

Powered by our talented and experienced organization, leveraging Digital and AI Capabilities.

Between 2026 and 2028, we plan to invest around €7.5 billion with US renewables at the core.

This approach supports consistent performance, strengthens the balance sheet and preserves flexibility for future investment.